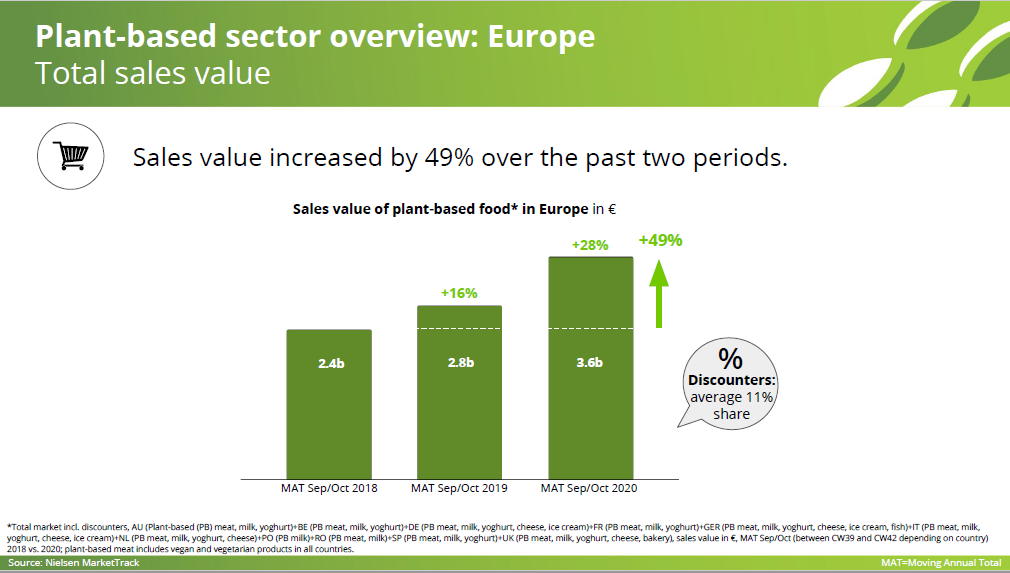

The Smart Protein Report, which was published in 2021, compares retail data from 11 European countries between 2018 and 2020 and shows a unanimous trend: the plant-based food market is growing rapidly. Almost all countries show double-digit growth in sales volume and value.

Germany has the highest numbers with 97% growth in plant-based sales value and 80% in sales volume with a total growth of €817m. The UK comes in second place, where the sales values for pb food grew 73% and 67% in volume, followed by Austria, Romania, The Netherlands, Spain, Denmark, France, Belgium and finally Italy with only 1% growth in sales value and 5% growth in sales volume. Nevertheless the total growth in sales value in Italy represents €490m.

Sales value and volume in discount stores are also strongly increasing which means plant-based food is becoming more accessible.

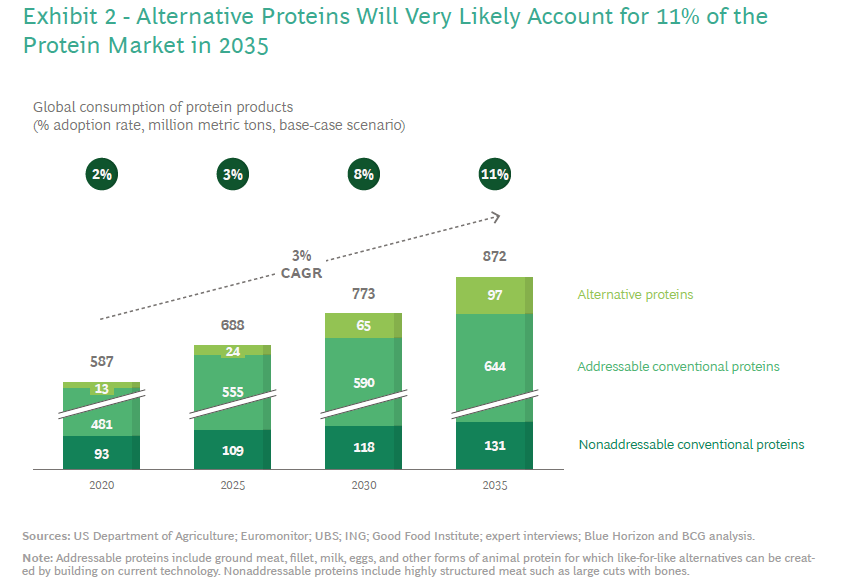

The Food For Thought – The Protein Transformation opinion from the Boston Consulting Group and the Blue Horizon Corporation project the alternative protein market to grow from 13 to 97 million metric tonnes a year in the next decade and a half. According to them, in 2035 it will make up 11% of the overall protein market, which would represent a value of $290 billion.

They expect another significant increase in interest for alternative foods once they reach cost parity with the respective animal foods.

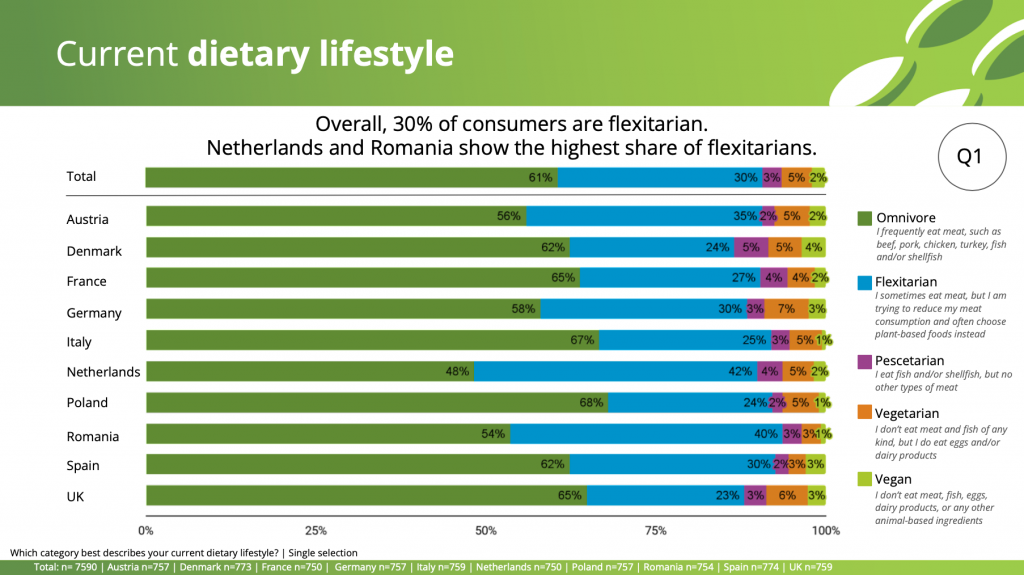

The Smart Protein Report on What Consumers Want, released in November 2021, gauges consumer opinions with regards to their diets and plant-based food options. This report complements the report released earlier this year and covered above, that looked at market trends.

The new survey shows that 37% of the Europeans in the sample identify as flexitarian, vegetarian or vegan, 30% of which are flexitarian

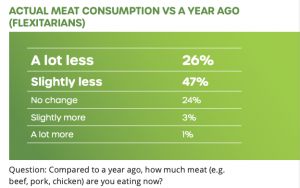

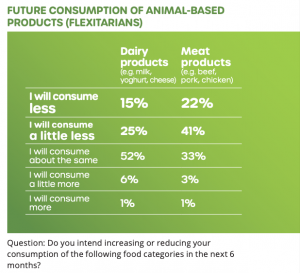

73% of Flexitarians were eating at least slightly less meat than a year ago. 63% said they plan to reduce their meat consumption even further in the future. 40% plan to reduce their dairy consumption as well.

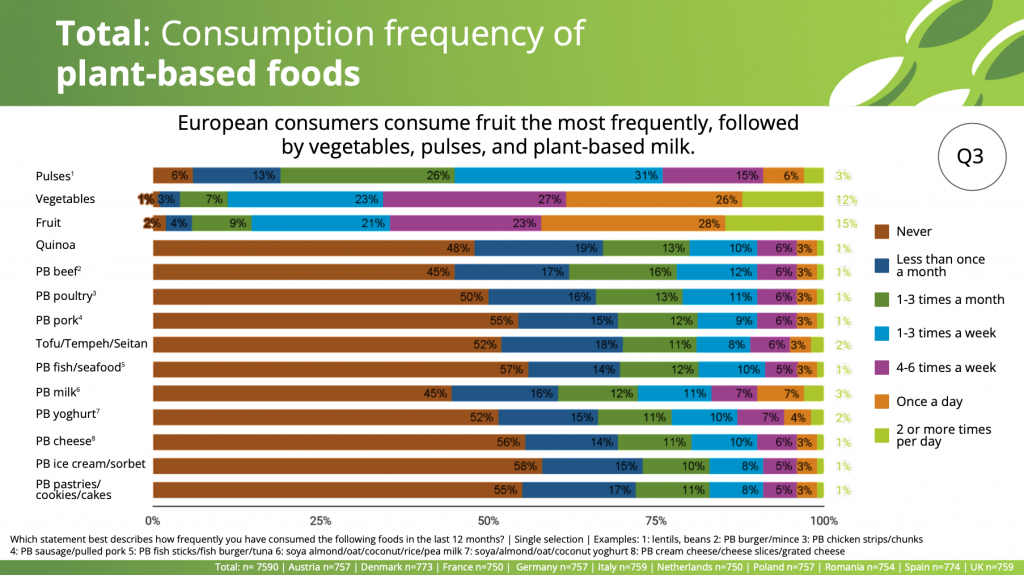

Currently, plant-based milk and beef are the most popular plant-based choices for consumers, with 55% of consumers at least occasionally enjoying plant milk and preparing plant-based beef products. 26% of respondents reported that they’ll be consuming more plant-based dairy in the future and 25% plan to increase their consumption of plant-based meat products. Only 3% of flexitarians say they are not at all likely to try plant-based meat.

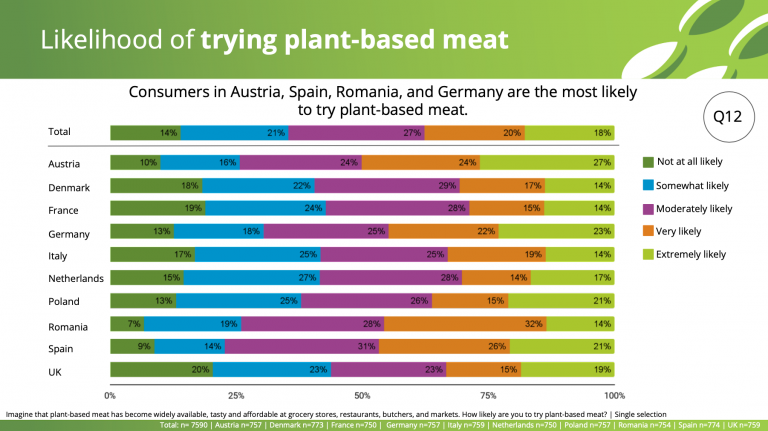

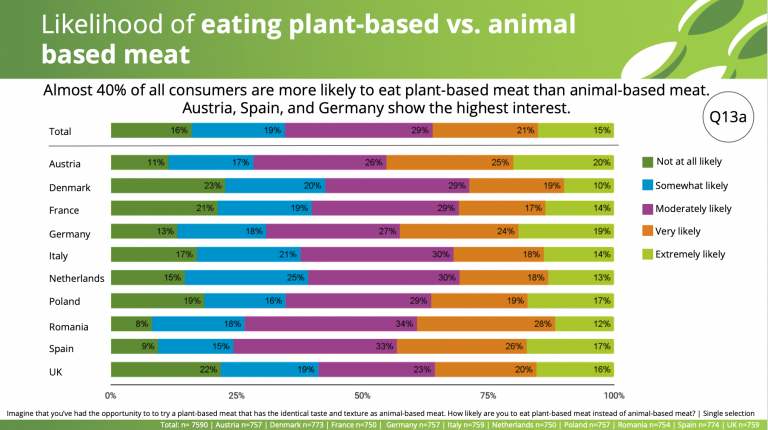

When asked to imagine a future where plant-based products are widely available, tasty and affordable wherever they shop, resounding majorities, from 80% in the UK to 93% in Romania said they were at least somewhat likely to try plant-based meat. Similar majorities said they were at least somewhat likely to replace animal-based meat with plant-based meat.